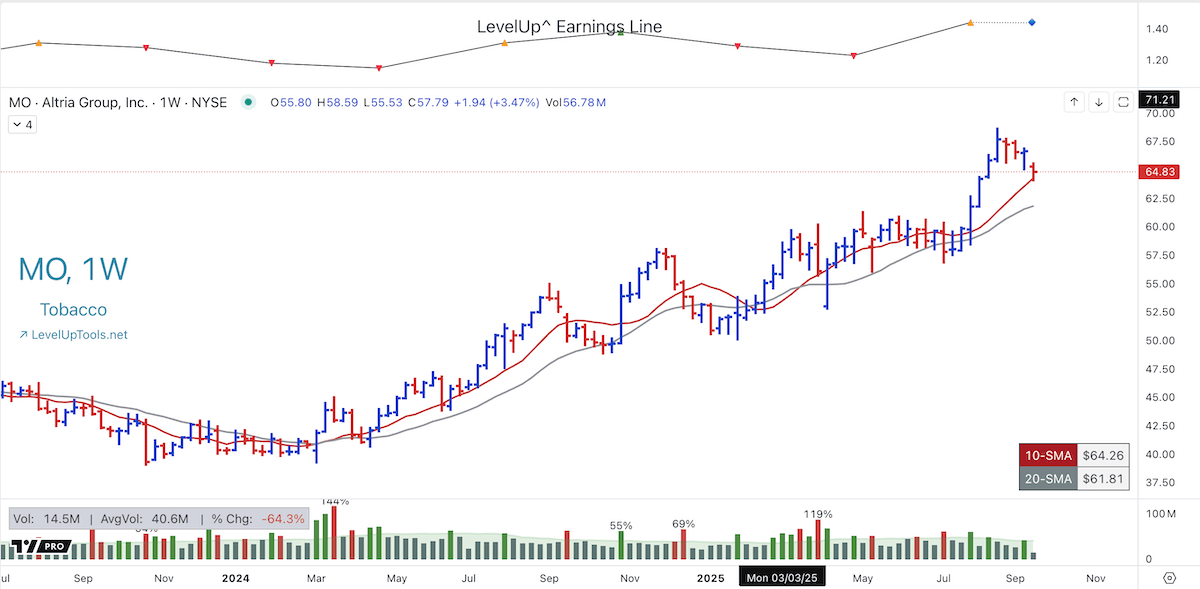

Welcome to an insightful journey into mastering the art of trading pullbacks using the TradingView LevelUp Pullback Screener Pro. In this tutorial, we will explore the strategic advantage of pullback trading, delve into the screener’s functionalities, and provide a practical guide for both daily and weekly timeframes. I’ll walk through how to utilize moving averages and configuration settings, equipping traders to make informed entry and stop decisions with confidence.

Why Trade Pullbacks?

Instead of frantically chasing after price movements, savvy traders capitalize on pullbacks to areas of support. This approach not only offers a logical entry point but also places a well-defined area for a stop. By positioning entries at the high of the bounce-back bar, traders take advantage of strategic price rebounds.

Summary

Trading pullbacks offers potential opportunities to enter positions at defined support levels instead of chasing volatile price movements. In this By configuring the LevelUp Pullback Screener with defined settings and observing example charts, traders gain a structured approach to entering and managing trades efficiently across both daily and weekly timeframes. This technique ensures that traders remain methodical, aligning entries and stops logically.